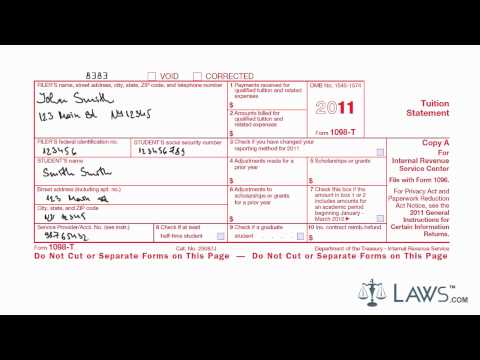

Laws dot-com legal forms guide form 1098-t is a United States Internal Revenue Service tax form used for providing information about a student's tuition payments during a taxable year. The form is used to determine if tax-paying students or their parents qualify for the American Opportunity Credit. The form 1098-T can be obtained through the IRS's website or by obtaining the documents through a local tax office. The tax form is to be filed by the school or college the student is enrolled in during the taxable year. First, you must supply the tax filer's contact information, including their name, address, city, state, and telephone number. In the first space below the contact information, provide the filer's federal identification number and the student's social security number. Next, put the student's contact information, including the student's name, street address, city, state, and zip code. If you have a service provider account number, provide that number in the bottom left corner of the form 1098-T. Next, the school must supply the tuition amount information in es 1 and 2 to the right of the filer's contact information. First, provide the dollar amount of payments received for qualified tuition during the tax year. Below that, put the amount billed during the tax year for qualified tuition. Indicate if your institution has changed the reporting methods for the current tax year. If any adjustments apply to the student's tuition, state them in 4. If the student received any scholarships or grants, write that amount in 5. If any provided scholarships or grants have been adjusted during the tax year, write in the amount in 6. If the total tuition amount stated in the above es includes tuition for the following semester in the next tax year, indicate so in 7. Indicate if the student...

Award-winning PDF software

Typical 1099 Form: What You Should Know

What Is Form 1099? — TurboT ax Ax Tax Tips & Videos How To Use Your TurboT ax 1099 Form On Schedule C Jan 28, 2025 – 1099 forms are used frequently by companies to report the types of non-salary income paid to their employees. In general, any employer that has a wage withholding requirement should report any non-employment income on a 1099 form. Any employee who isn't required to withhold taxes by a paycheck-retaining employer should report non-salary income on a 1099 form. The 1099 form shows the employer which payments are being made to that employee. The amount of information reported depends on the type of payment. Tax forms in the forms.gov.gov database detail the amount and type of income reported. Dec 16, 2025 — Income tax return forms available in the forms.gov.gov database, such as the 1099-DIV, 1099-INT, 1099-MISC, 1099-S, and others, explain the rules that apply to a business or individual who makes a payment to another. The forms contain a lot of useful information about what to report and how much. These tax forms are also used to find the correct tax forms for a tax year. Do These 1099 Forms Report Tips? — TurboT ax Tax Tips & Videos About Tax Forms 1099-MISC, Miscellaneous Income — IRS How to Apply the Determinant on Form 1099-S. You can calculate a tax deduction on an income tax return for unreported tips based upon the fact that unreported tips are not taxable in all cases. See Tax Forms 1099-MISC, Miscellaneous Income, and IRS Publication 524. What Does an IRS 1099 Is? — IRS How to Report Tips and Other Unreported Income on the 1099 Form: IRS 1099 Form — IRS When to Use Payroll Incentive Payments On your W-2 Income Tax Form 1099-MISC. Your employers may offer a cash or in-kind incentive payment, as you'll see in this article. Dec 22, 2025 — Tax forms 1099-MISC, 1099-K and 1099-W are used to report information regarding the amounts of tips, royalties, fees, commissions, or other payments paid to employees by a non-profit organization. They also detail whether such payments are taxable.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1099-MISC, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1099-MISC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1099-MISC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1099-MISC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Typical 1099 form